Finding great Government contracting teammates can increase your chances of winning a contract award. However, if you don’t invest time into selecting the right partners, you instead increase your chances of losing. In our previous article on the benefits and downsides of contractor teaming, we looked at why federal contractors team.

In this article, we’ll describe how you can gather a list of high-potential prospective teammates, and how to research and qualify (or disqualify) them.

Avoiding the “Bob Factor”

Most companies use the “Bob Factor” when figuring out who to team with. The Bob Factor normally plays out like this.

- “Oh wow! This opportunity looks outstanding. Hmm, I probably need to team though, because I don’t do this part. Who could I team with?”

- “I know! I know who to team with! Bob’s company. I really like Bob, and this looks like the sort of work his company does.”

So you immediately call Bob. You tell him about the opportunity and tell him how excited you are to work with him. You and Bob both are excited.

Except the customer didn’t know Bob. Bob’s past performance wasn’t exactly the perfect fit. So, you and “Bob” didn’t win the contract award. What’s worse, you never connected your decision to team up with Bob with why your win probability (Pwin) went down and you lost the opportunity.

If you had been more methodical in your teaming partner selection process, you would’ve increased your Pwin.

Why did you default to calling “Bob”? Because humans are conditioned to work in “tribes.” We stick with the same group of comfortable people, and tend to seek opportunities to work with those we trust again. It’s actually a good thing.

The problem is that just because you met someone in a social setting, or even a previous professional role, doesn’t mean you should bring them into your current professional projects automatically, without doing proper analysis.

Sometimes “Bob” can help you win an opportunity. However, we find that the opposite is most often the case, because calling “Bob” replaces a proper course of action. Even if you think “Bob” is a great teaming partner candidate, you should still include his company on par with other teaming candidates in a rigorous evaluation process.

Where Do You Find Your Ideal Teaming Partners?

We have established that your first step is to resist the temptation and avoid calling “Bob.” Your next step is to build a list of potential competitors for an opportunity. Search for companies that have:

- Same or similar agencies’ work

- Right NAICS and PSC codes for the capabilities you’re looking for

- Proper company size for the pursuit

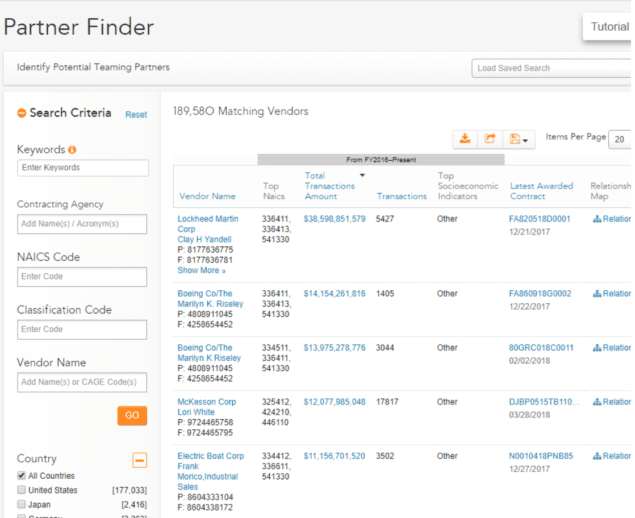

You can use a tool like the Partner Finder in Bloomberg Government to apply filters for these basic criteria.

By applying additional criteria, such as size or socioeconomic status, while adding relevant keywords, you can create a relatively short list from potentially dozens of possible companies who use a particular NAICS code at the target agency. If you don’t find any companies, you can always broaden the search. It’s more efficient to start out with a hyper-specific search and widen the search scope as you eliminate possibilities.

The agency may also list their mentor-protege program participants in the Small Business portion of their website, which may show active players at the agency.

When you do a gap analysis of the work you perform (and don’t perform), you can search for complementary companies that do the work you don’t do for the agency.

Can The Incumbent Prime Again?

You must also consider the incumbents for a given opportunity. Can they prime on this contract again? If they originally bid as a small business or some sort of a socioeconomic set-aside such as the 8(a) program, but that was 3-5 years ago, they may have outgrown their NAICS code’s small business size standard or their status.

You can download the latest size table from the SBA website, and search for the NAICS code your interested in. The table will also list exceptions. You may find that the current prime’s revenue over the past three years (or five years according to the new law that hasn’t been implemented yet) is too high to prime on the contract this time around.

If you’re approaching this opportunity early, you may be able to woo the current prime to join your team, and leverage their past performance to increase your Pwin.

Researching Prospective Teammates

You’ve created a pool of potential teaming partners that would fill the capabilities gaps you can immediately see. You can obtain some information from a company’s Bloomberg Government (BGov), DACIS, or GovWin IQ profile. The sort of information that may help you make your decision may include:

- Their primary areas of work

- Revenue patterns

- Contracts or contract vehicles at their disposal

- Prime obligations

Now you have to dedicate some hours to sift through the data available to you to pick the best possible partner out of all of them.

To verify what they do specifically on each contract, you may want to type that contract’s number in your web browser, or use one of the paid databases, such as BGov, that we just talked about. You may get the old RFP with a detailed statement of work.

Invest time in reading it prior to your conversation with the company. It’s amazing the magic that happens when you go into teaming conversations prepared. But more about that in our later articles.

Note that it can be harder to find subcontracting experience information. If a candidate company actually had a teaming partner perform the work scope that would complement your team, then their teaming partner is who you’d be interested in.

If the contracts required a small business subcontracting plan and your candidate teaming partner is a large business, then you may glean some information. Additionally, search the web for any press releases or articles that may discuss the team.

You may see what companies do on each contract, but you won’t know how well they do it. Government customers can see in the past performance database exactly how well a contractor is executing a contract. That’s not data available to us on the outside other than some rumors that they aren’t doing well.

Review the Companies’ Websites and Social Media Accounts

You shouldn’t have much trouble finding each company’s website. A Google search should bring it up, if you don’t have access to one of the research databases. You’ll likely find the company’s capabilities information, certifications, contracting vehicles and past performance projects description, news, and leadership’s bios.

Any news about recent developments in the company, like strategic partnerships, mergers, and acquisitions may be relevant to your teammate search.

Going back to that Google search, you may find relevant information from sites such as Glassdoor or LinkedIn. Now this information may be true or not, but it’s all apart of the puzzle pieces you’re trying to put together to understand potential teaming candidates and build a short list of partners you would want to approach.

When looking at LinkedIn, you may find people you know at the companies you’re researching. Depending on how well you know them, it may be a good opportunity to reach out and see what they can tell you about the company.

Doing a Capabilities Analysis

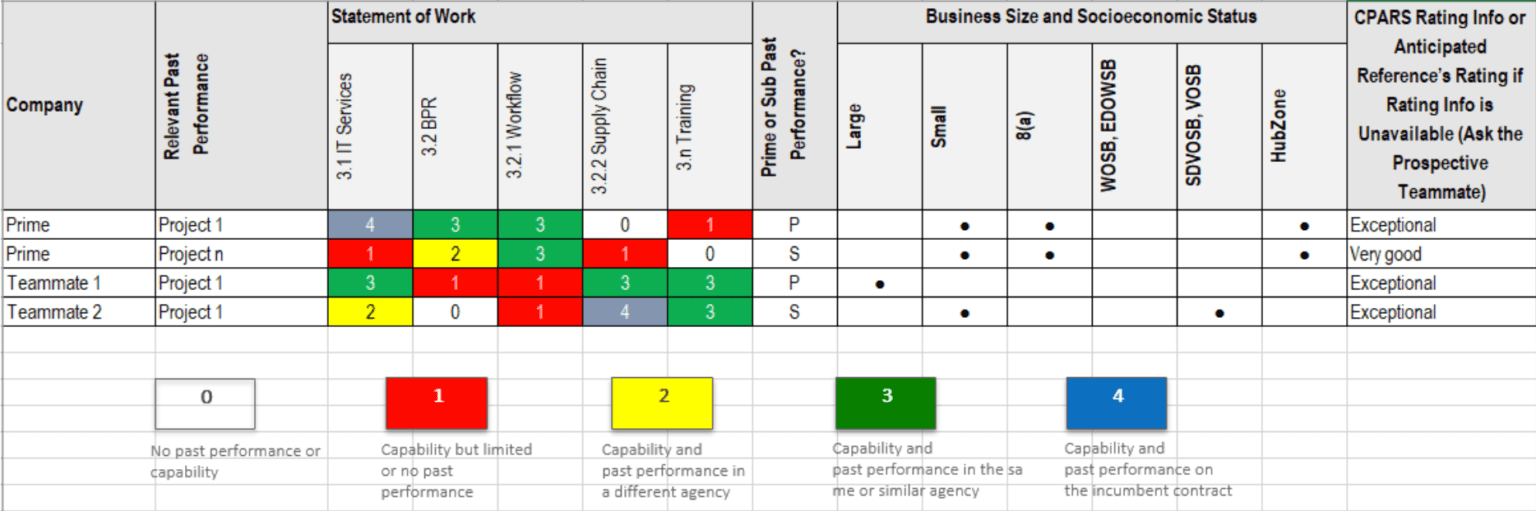

Now that you have collected all this information, it’s time to do some more detailed analysis. The gap analysis you did earlier in your head is not enough. We can tell a professional capture manager from a capture manager “in name only” by whether they use a thorough analysis or just ballpark everything. Here is an example of a capabilities analysis list you should use to do your detailed analysis.

The Capabilities Analysis template has multiple uses:

- A potential teammate selection tool when you fill out a less detailed version of the statement of work

- A more granular gap analysis tool that teaming partners can fill out once they join your team and you have them fill out the detailed statement of work analysis on their own; based on that analysis, you can add additional teaming partners or hire people to fill the gaps

- Past performance selection tool for presenting in your proposal

- Tool to select Subject Matter Experts (SME) teamwide for your solution brainstorming

- Subcontracting plan for large businesses to small businesses

- Author selection tool to find the SMEs best suited to write each section.

Contact us to learn more.